Hello everyone 👋

Just a quick reminder - every two weeks, I drop by with the freshest insights and discussions on the thriving European tech scene straight into your inbox.

In this edition, we break down the insights from Pitchbook’s Q2 2023 European Venture Report. For entrepreneurs and investors alike, this is your essential guide to understanding and leveraging the latest trends from the first half of the year.

👉 For the original report, see here: https://pitchbook.com/news/reports/q2-2023-european-venture-report

Let’s get started.

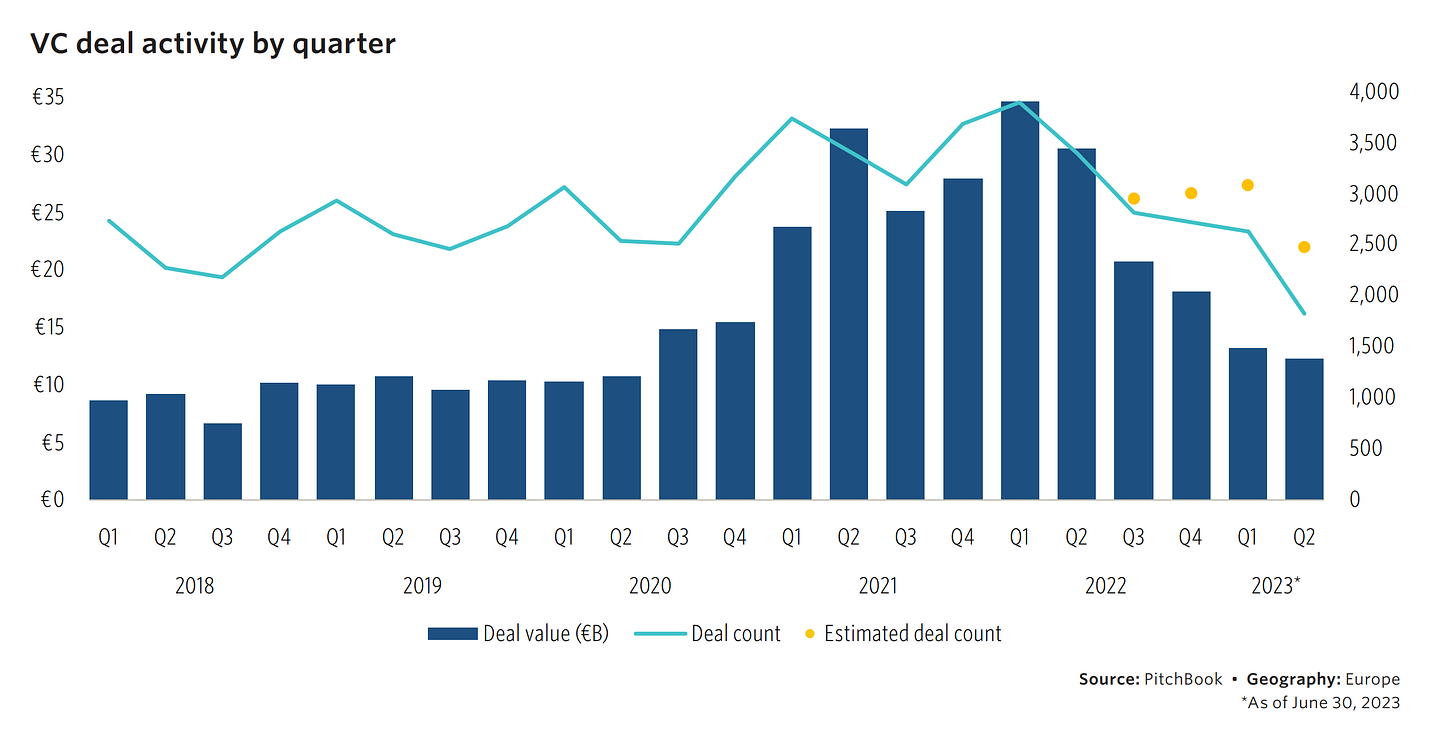

1. VC Deal Activity in H1 2023: What’s Behind the Dip?

The first half of 2023 witnessed a sharp decline in European venture capital deals value. Pitchbook's data reveals a 60.8% decrease compared to H1 2022, and a 34.2% drop from H2 2022. Echoing this, Atomico's 'State of European Tech Report 2023' projects a year-end total of around $50B, which is a significant 50% fall from 2021. However, this still stands 35-40% ahead of 2019-2020.

What's causing this slowdown? A mixture of macroeconomic challenges is to blame: surging interest rates, high inflation rates, a tougher IPO exit landscape, and difficult fundraising conditions. While public market resurgence could hint at private market rebounds, the ECB and Fed's relentless battle against inflation with rate hikes suggests the recovery journey might stretch beyond 2023

2. Efficiency Takes Center Stage: Rethinking 'Growth at Any Cost'

The unfolding story of H1 2023 suggests VC-backed firms are recalibrating. With dwindling IPO opportunities for unprofitable ventures and fundraising challenges, the previous mantra of 'growth at all costs' seems to be on the wane.

Instead, strategic resilience is the new game in town. Investors and startups are emphasizing internal restructuring and lengthening financial runways. This has, unfortunately, led to a spike in layoffs and hiring freezes in the startup arena. The tech sector, previously synonymous with rapid growth, has likely taken the strongest hit of all sectors. A glaring example is GoCardless, the UK's unicorn payments startup, slashing 15% of its global workforce in June 2023. Efficiency is no longer a buzzword; it's a necessity.

3. Down Rounds in Q2: The New Normal?

The VC terrain is evolving, and down rounds are increasingly becoming a focal point. An eye-opening 26.3% of European VC deals in Q2 were down rounds. For startups with slow growth trajectories and immediate capital needs, this has become a stark reality. Getir's recent fundraising journey, culminating in a valuation dip of a staggering 42.4% in one year (from $9.9m to $5.7m), underscores this. The message is loud and clear: in the current climate, securing funds might come at a steeper price, especially for less efficient startups needing funding to survive.

4. Early vs. Late Stage: Who Bears the Brunt of the Downturn?

As the VC climate shifts from an age of ample capital and minimal interest rates, the data suggests a tilt towards larger deals. These primarily manifest as follow-on VC investments, giving startups a vital lifeline.

Deals in the €10 million to €25 million range saw a 39.1% YoY drop in deal counts. Even more striking, smaller deals, both within the €500,000 to €1 million bracket and those below €500,000, suffered YoY declines in deal counts of 65.9% and 64.0%, respectively.

Yet, Atomico provides a nuanced view in its State of European Tech 2023 - First Look report. Despite the funding slowdown, early-stage funding (or those sub $15M rounds) in Europe has displayed remarkable tenacity. H1 2023 saw just a 21% dip in total early stage deals value from H1 2022's $10.3B, settling at $8.2B.

A concerning trend for entrepreneurs though: angel and seed deals count has seen four straight quarters of dwindling share. Which signals that investors are currently favoring follow-ons over fresh bets.

5. Valuation Adjustments: Europe's Stage-by-Stage Overview

In a VC environment where deal activity is ebbing, median valuations across stages are realigning. Here's a breakdown:

Angel's Endurance: Angel valuations, impressively, rose by 10.7% from 2022, settling at a median of €3.1 million. This stability, often distant from exit-related pressures, suggests that angels might feel the market recalibration pinch later than their early and late-stage peers.

Early-Stage Adjustments: Early-stage valuations have decreased by 11.4% YoY, standing at a median of €6.2 million for H1 2023. Yet, Q2 presents a promising 27.5% median valuation surge, ending three consecutive quarters of decline.

Late-Stage Recalibration: The most significant change was witnessed in late-stage valuations, which saw a dip from €12.4 million in 2022 to €10.8 million in H1 2023 — marking the first decrease in nearly a decade. As these valuations often mirror public benchmarks, the volatile equity market's tremors resonate here, hinting at potential further adjustments in 2023.

6. US Investors in European VC: A Shift in Focus

US participation in European VC deal value has notably decreased in 2023, with a 69.2% YoY and 13.0% QoQ decline in Q2 2023. Several influencing factors can be pinpointed, including greater uncertainty regarding monetary policy between regions, less risk appetite for cross-border deals given the funding requirements of local portfolio companies, and the repercussions of US bank collapses in 2023. The trend suggests that US investors are more inclined to manage and stabilize their existing portfolios than to expand into new regions.

7. Exit Dynamics: Sounding the Caution Bell

The VC arena is ringing warning bells, as exit activities drop to their lowest in a decade. Notable industry giants like Stripe, Klarna, and Snyk are grappling with valuation reductions. In numbers: H1 2023's exit value stands at a mere €3.5 billion, forecasting a year-end that's 82.2% shy of 2022. Q2's exit value? A concerning €0.9 billion, down 64.9% from Q1.

However, amidst the challenges, there's a glimmer of hope: a pivot from speculative investments to those rooted in tangible, intrinsic value. This change may herald more sustainable growth and reduce tech market volatility.

In Conclusion: Navigating Through a Strategic Reset

Our insights highlight a crucial reset in the VC landscape: deal activities are waning, prompting strategic shifts among VC-backed entities. But that's just one side of the coin. Even with the current downturn, the ecosystem remains robust, outperforming 2019 and 2020 figures, illustrating its inherent resilience.

We're possibly witnessing not so much a decline but a recalibration. 2021's peak might be attributed to a market overdrive, where unchecked expansion overshadowed sustainable growth. The present drop may just be a necessary market correction, a return to balance.

Herein lies the positive spin: with recalibrated valuations and public markets favoring foundational metrics, there's a move away from mere speculation. However, the shadows of exit stagnation and liquidity issues cannot be ignored. The VC landscape's charm has traditionally been anchored in the potential for lucrative exits. If these exit opportunities continue to wane, investor enthusiasm might understandably wane with it.

Now, we’ll soon see if the trend confirmed in Q3.

That’s all for today’s edition folks. Thanks for tuning in. Stay curious and ready to dive deeper. See you in two weeks with more tech insights!

Take care,

Tim