Good morning Upscalers’ followers.

Time to bring you the 6th edition of our weekly journal.

This week we’ll talk about Climate Tech. Plus, we selected this week’s most interesting articles about the EU ecosystem.

As always, feel free to like, comment, react and respond. Thanks for reading!

And if you enjoy our content, why not join Upscalers as a member?

Time for Climate (Tech)

Today is the end of the World Climate Summit (COP26) in Glasgow. I figured it was a perfect timing to talk about Climate Tech 🌍

1. What is climate tech? 🤔

In the 2000s, concerns over rising energy prices tied with rising greenhouse gas emissions led to the creation of 'Cleantech'.Investors around the world poured tremendous amounts of money to fund companies focused on developing clean technologies, which promise was cheap renewable energy to replace fossil fuels. We're talking about roughly $25B worldwide.That later became known as the Cleantech bubble 1.0. Due to a whole variety of external factors such as...

... the global recession which dried up the market for investments and undercut oil prices...

... China's manufacturing prowesses in solar panel production...

... the rise of new extraction techniques such as 'fracking' which tapped into new domestic natural-gas reserves.

... the bubble burst. Companies failed to even return the investments, and investors were scared away from the sector.Yet, climate tech is up again and now trending. And this time, it is different.

2. Is it truly trending and why? 🌱

For starters, cleantech was only a subset of climate tech, which focused on alternative energy while climate tech is much broader.Climate tech is about any sector which tackles the challenge of decarbonising the global economy. It includes:

"Low-to-negative carbon approaches to cut emissions across energy, built environment, mobility, heavy industry, and food and land use; plus cross-cutting areas, such as carbon capture and storage, or enabling better carbon management, such as through transparency and accounting", PWC says.

To me, having such a broad definition is a positive sign that we've acknowledged the impact of the climate crisis on our lives and economies, and that we starting to act about it by looking at millions of ways to approach the problem, apart from energy alone.

In the early 2000s, when 'cleantech' was rising, renewable energy technologies were simply not mature enough to be commercially viable.

Now, climate tech looks a lot more different.

Technology advances have driven down the cost of renewables

Meaning climate tech is less capital intensive.

So it makes perfect economic (and environmental) sense to found or invest in startups enabling, accelerating and capitalizing on the renewable energy economy.

On top of that, there seems to be a growing sense of urgency, creating a favorable context for climate tech companies: international climate policy has become more rigorous, governments have unlocked resources to fight climate change, corporates are slowly committing to reduced carbon emissions and investors look at ESG factors to evaluate opportunities.

3. So where do we stand? 📊

Since the 2016 Paris Agreement, investment in Climate Tech companies grew x4.9, reaching $B32.3 this year (YtoD).

Europe is now emerging as the fastest growing region for climate tech, with investment growing 7 times since 2016.

European climate tech funds proliferate across multi-stages (from Seed to PE). Larger ones are:

Lightrock 🇬🇧, $900M fund size

🆕 World fund 🇩🇪, $350M

2150 🇬🇧, $312M

Blue Horizon 🇨🇭, $200M

<norrsken> 🇸🇪, $138M

Pale blue dot 🇸🇪, $96M

You probably also heard about grassroots initiatives such as Time for the Planet, a nonprofit company that creates and finances companies fighting against climate change at a global scale.

I personally back the initiative, and think it is a good way to get involved (beyond investing in climate tech companies through Upscalers 😊).

4. What are the hottest trends? 🔥

Again, Climate tech is broad and transversal. So here is just an overview of some trends we are particularly interested in within the team:

Mobility - micromobility ($9.1B raised worldwide from 2013 to 2019, Dealroom data), Low GHG road transport ($19.4B)

Food, agriculture and land use - alternative foods and low GHG proteins ($2.4B)

Energy - renewable energy generation ($1.7B) and storage ($1.2B)

I have concerns about Carbon Capture technologies, which are fairly controversial. I'd be curious to hear your toughts on this.

Tell us what trend you are most bullish on and we'll dig the best early stage startups for you 😉

Also, if you want more insights on Climate Tech, I encourage you to subscribe to Climate Tech VC ⬇️

All eyes on the EU... and elsewhere

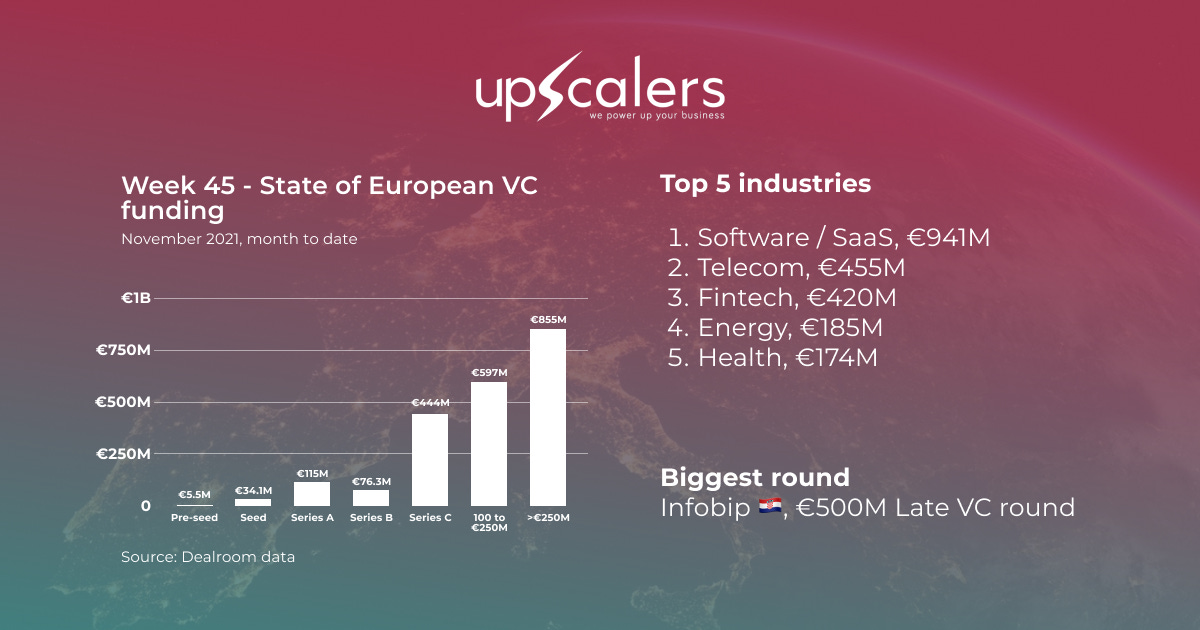

European funding this month (to date) 🇪🇺

Zilch closing an impressive $100M Series C 😮

The london based buy now-pay later startup Zilch, just closed a $100M Series C round, at a $2B valuation.Nothing quite unusual so far.But I didn't tell you that the two cofounders still hold 50% of the company. And that they are the fastest startup to become a unicorn in Europe. That's some sort of achievement 👏

... and elsewhere

Rivian's hot IPO 🔥

On November 10th, US electric car manufacturer Rivian priced its IPO at $78 per share. The company, expects to raise around $12B, placing the valuation at... $77B.You know who's happy about it? Good old Jeff, as Amazon reportedly holds 20% of stakes in the company.

Thinking of starting a series on dumbest crypto moves 🤦♂️

Crypto news!

On Monday, Elon Musk changed his Twitter name to Lord Edge (for whatever reason).

So of course someone created a memecoin with the same name...

And of course it went crazy up in a matter of hours (+360% in the first three hours). Until it eventually crashed (for common sense' sake).

I know I have been sharing crazy crypto stuff only in past editions of this newsletter. Yet, I believe there is some great potential in this asset class. So I'll write you something about it next week.

Food for thoughts 💭

... and if you find someone who believes in the story, make it a startup and go raise some money.

Thanks again for reading guys

See you next week 👋

Tim