🥗 Suboptimal allocation of capital in FoodTech

December 20th, 2021 - December 24th, 2021 - 5-min read

Good morning Upscalers’ followers.

Time to bring you the 12th and last edition of our weekly journal for 2021. Here's what we’ll talk about this week:

Latest trends in FoodTech - investing where we don’t need it the most 💡

As always, feel free to like, comment, react and respond. Thanks for reading!

And if you enjoy our content, why not join Upscalers as a member?

💡 Latest trends in FoodTech - investing where we don’t need it the most

Last week, I mentioned that Infarm had raised a $200M Series D making it a unicorn. Then, I promised I'd talk about FoodTech this week.

So here we go ⬇️

1. What is Foodtech? 🤔

I like to understand Foodtech as a broad category, that covers all innovations affecting the Food supply chain. Not only does this gives a more comprehensive picture, but it also allows to better understand where capital is allocated along the supply chain (and ultimately, what priorities investors have...).

Foodtech covers:

Agritech, which refers to land use and farming practices

Innovative food, which covers all food production methods commonly using biotech, that often replace carbon intensive animal based products, such as synthetic proteins or insect proteins

Food logistics and delivery, which is self explanatory

In-store retail and restaurant tech, which covers payment services, reservation platforms, foodservice management, cloud kitchens and any solution for the food retail industry

Kitchen and cooking tech.

In 2021, Foodtech startups belonging to at least one of these categories accounted for 7.5% of all VC investments in Europe ($9.1B invested).

2. Investing where we don't need it the most 🎯

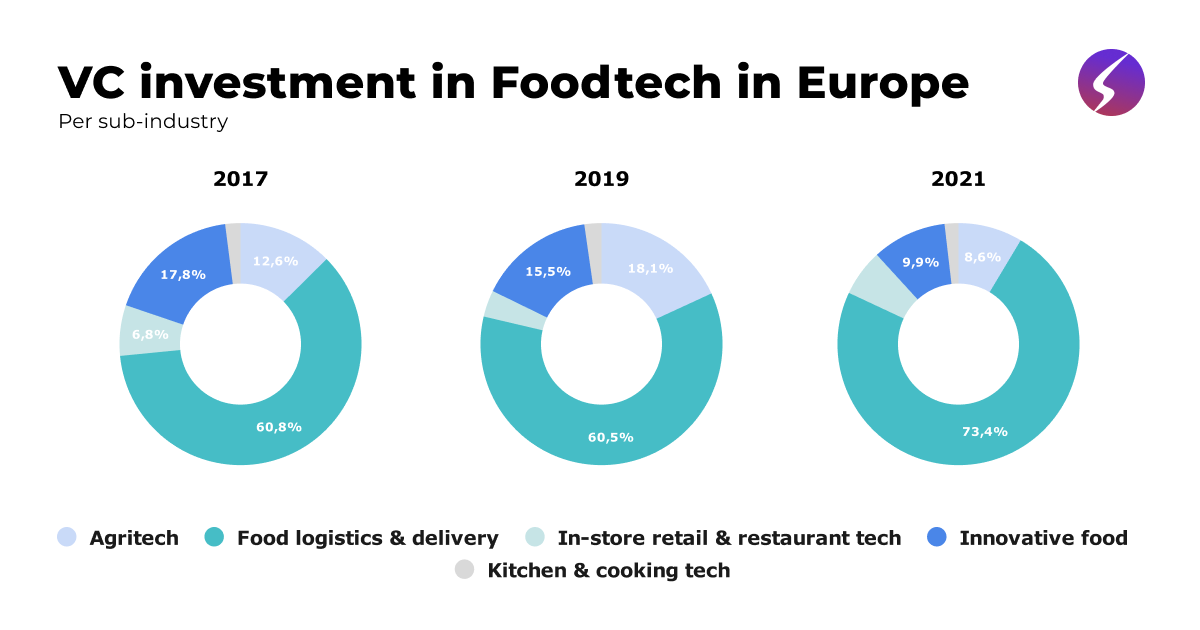

What's staggering is that investment increased x2 from 2020 to 2021. Growth has been powered by the exponential rise of multiple European Food delivery startups (including Gorillas, Flink, Picnic...) which raised crazy rounds over the past 12 months.

As a result, food delivery remains by far the n°1 most invested in sector in the Food industry.

I already talked a lot about food delivery, so let's not focus on this.

What's strikes me overall is that it looks like a suboptimal allocation of capital, considering the huge challenges underlying food production.

3. Solving the world's biggest problems - GHG emissions 💨

The food system that currently feeds the world's population accounts for approximately 26% (13.6B tons) of global GHG emissions.

Livestock agriculture is the highest contributor. Of the 13.6B tons of GHG emissions, around 31% is attributed to methane release from enteric fermentation (digestion), and 18% to land-use for livestock. Considering that by 2050, global population is expected to grow by 25%, we'll be facing an acute increase in GHG emissions if we do not transform the way we grow food.

There are very significant areas where startups, emerging technologies and farmers can make a huge difference... and where funding can have impact!

First, we urgently need to improve climate efficiency of current farming practices AND find innovative approaches that are less carbon-intensive such as precision farming, vertical farming etc. Notable startups such as Ynsect or Infarm are already heavily funded to become world leaders in the field.

Second, land use and management is relatively outdated, so it is prone to Tech as a disruptor. We'll soon present an opportunity which uses data to optimize soil utilization to the Upscalers community. We're pretty excited about it. More on this in January ⏳

Third, we need to focus on new forms of nutrition which includes alternative proteins. There are four alternative proteins that offer promising opportunities for the future:

🌱 Plant protein, such as soy, pea, chickpea, rapeseed, lupin..

🐛 Insects, such as mealworms or black soldier flies

🍄 Mycoprotein, from fungal biomass

🥼 Cultured meat, which is lab-grown animal protein using tissue-culture technology.

Overall, plant proteins are expected to be the largest source of alternative proteins in the future, because they have a limited environmental impact, a good perception by customers AND advantageous economics. Plant proteins avoid the 'feed-to-food' conversion loss which is typical of other proteins.

Last but not least, we will have to look at carbon capture technologies if we want sustainable levels of GHG emissions. I won't be talking about carbon capture technologies here, I might dedicate a whole newsletter to this topic in the near future.

4. Solving the world's biggest problems - water 💧

There's also another crisis to which Agriculture is a MAJOR contributor: the global water crisis. Water used for irrigation, livestock and acquaculture underpins the world food system. Globally, agricultural water use surpasses any other applications, accounting for around 70% of water withdrawals.

Agriculture is also a major source of water pollution which is causing public health crises from contamination of groundwater.

There's a lot to do in the field. Startups using data, sensors, aerial imagery technologies or AI can help farmers make the most of every drop while maintaining water quality.

We are currently reviewing an opportunity which is an AI driven B2B SaaS to map, prevent and cope with water pipe leaks. I guess we'd all find ourselves very happy if we could contribute to fund such startups, which try to solve a global problem, and contribute to the Agritech sector recovery. Agritech has been massively underfunded in Europe in 2021 ($785M) compared to 2020 ($1.4B).

5. Startups to watch

I strongly encourage you to have a look at Sifted’s list of Agritech startups to watch.

On top of this, I can only recommend that you register to join us as members of the community, and have a look at the great deals that we'll select for you in early January. Those are golden tickets 🎟️

🌍 All eyes on the EU... and elsewhere

European funding in December 🇪🇺

VOI becomes a unicorn 🛴

This week, the Swedish micromobility startup announced it has raised a $115M Series D funding round, as it plans to move to new cities in 2022. Congratulations to Carl Vernersson, CCO of the company, and member of the community! Well deserved Carl 👏

Dealroom raises a $6M round 📊

You know how much of a fan of Dealroom I am. Most of the data we use at Upscalers comes from their platform.

So I wanted to share with you that Dealroom has just raised a €6M Series A funding round this week.

NFT satire of Boris Johnson 🇬🇧

A new project has just been released on the NFT platform OpenSea, called Non Fungible Tories - The Boris drop ⬇️

This consists of a series of NFTs based on Boris Johnson's most famous quotes. Pfeffel, the UK-based artist behind the project says it is a satirical tribute to the British PM, whom he consider to be '“a clown, an oaf, a wager of culture war, and a pound-shop Churchill”. Ouch.

The artist has claimed that the charity Crisis at Christmas, which helps the homeless on U.K. streets will benefit from the NTF auction. It's good to see that charities start to benefit from the 'frenzy'.

Thanks again for reading guys

See you next year 👋

Tim