🚀 Predictions for European Tech in 2022

January 3rd, 2022 - January 7th, 2022 - 5-min read

Good morning Upscalers’ followers.

Time to bring you the 13th and first edition of our weekly journal for 2022. This week, I’ll give you my Predictions for European Tech in 2022 💡

As always, feel free to like, comment, react and respond. Thanks for reading!

And if you enjoy our content, why not join Upscalers as a member?

💡 Predictions for European Tech in 2022

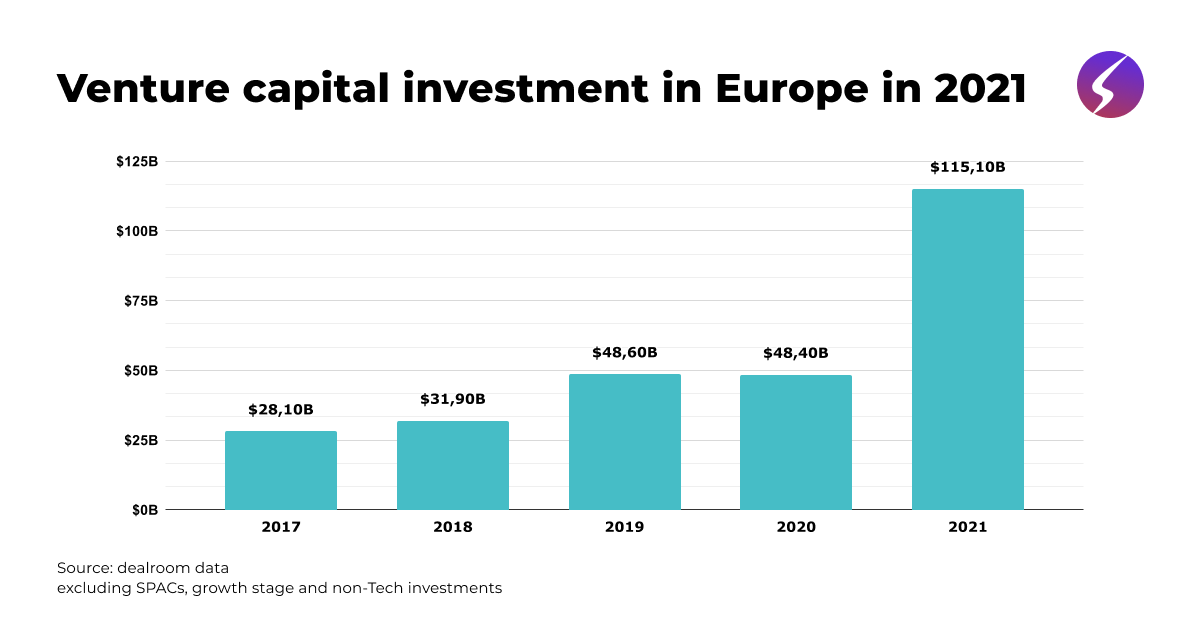

2021 has been a crazy year for European Tech with Venture Capital funding reaching new all time heights across all stages. As we are entering the new year, I figured it would be interesting to give our predictions for 2022 European Tech.

I’ll try to be brief and give you my top 10 insights on:

📈 What the Europen Tech ecosystem will look like a year from now

🎯 Where funding will go (in other words, what priorities will investors have)

🔥 What the hottest trends will be

There will be some bullish takes in this one, get prepared. Those reflect my vision of the market only.

Here we go ⬇️

1. 2022 European levels of funding will match 2021’s

Despite troubling times caused by the pandemic, venture capital investments in European Tech startups more than doubled from 2020 to 2021.

Our prediction is that European Tech will remain attractive to investors, resulting in similar levels of investment in 2022, compared to 2021. European companies that raised early stage rounds 10 years ago, are now achieving higher levels of maturity, and are likely to raise big rounds in the early 2020s.

2. Alternatives to local VCs will become more popular with founders

Gone will be the days where Pre-seed and Seed rounds were only looked at by local VCs and a handful of local angels’ clubs. We predict that this year more than ever, founders of early stage companies will raise funds from multiple sources including…

🤙 … ex-entrepreneurs turning investors (and communities!)

💸 … revenue financing (remember when I told you about Capchase?)

🏢 … international VCs going down the funding ladder to spot the best deals early on

The rise of new kinds of startup investors will also be powered by…

… startups facilitating investments either on the primary and secondary market (e.g., Vauban or Equisafe for setting up SPVs, or Caption Market for the secondary market).

… demands for more investors’ accountability and value beyond money (👋 Landscape)

3. Funding for women founders will remain low… but investment in women-led early stage startups will increase!

In 2021, women founders raised the lowest proportion of total capital since at least 2017. Figures dropped from 2.4% last year (which was a paltry all time high) to 1.1%. Venture capital sucks at backing women founders and promoting diversity in general.

Let’s be realistic. Overall levels of funding for women founders are likely to remain low next year.

Yet, there is hope for a better future. I can feel that there is a growing sense of awareness of the diversity issue in Venture Capital. So let’s be bullish. My bets are that, by the end of 2022…

… the share of early-stage deals funding (<$10M) captured by women will have increased from 7% in 2021 to at least 20%.

… the number of women and minorities fund managers will be greater than ever before in Europe.

Step by step.

4. There will be more investment in climate tech companies

2021 was a breakthrough year for Climate Tech. We saw record amount of capital being invested into the space and a greater-than-ever number of companies raising significant rounds. Since the 2016 Paris Agreement, investment in Climate Tech companies grew x4.9, reaching $B32.3 (data from Q3 2021).

On top of that, Europe is now emerging as the fastest growing region for climate tech, with investment growing 7 times since 2016.

My guess is that Climate Tech will continue to be trendy with companies raising larger rounds and more generalist VC funds raising dedicated climate Tech funds in 2022. 2021 already saw a bunch of developments on the investors’ side with Speedinvest raising a €80M climate tech focused fund, or Ecosia launching the World Fund to focus solely on Climate Tech.

I encourage you to have a look at Sifted’s list of fastest growing Climate Tech companies in Europe. There may be some future unicorns in there

5. 2022 will be the year of EdTech

3-months ago, I dedicated one of the first editions of this newsletter to EdTech investment. At the time, predictions from Brighteye Ventures (Europe’s biggest edtech VC firm) were that EdTech investment in Europe would hit $1.8B by the end of 2021.

Eventually, $2.2B were invested in EdTech in Europe in 2021, which is more than double the amount of 2020 ⬇️

My assumption is that, with the future of work, not only will people take meetings in the Metaverse, but they will be changing jobs more regularly than ever before (especially Gen Zers). Digital ways to learn and refresh skills will get more and more traction as job turnover increases.

It is also likely that EdTech solutions will integrate further into learning delivery and learning processes and disrupt traditional education as we know it. There is a lot to do in the space, so I can only imagine that well-funded startups will flourish in 2022.

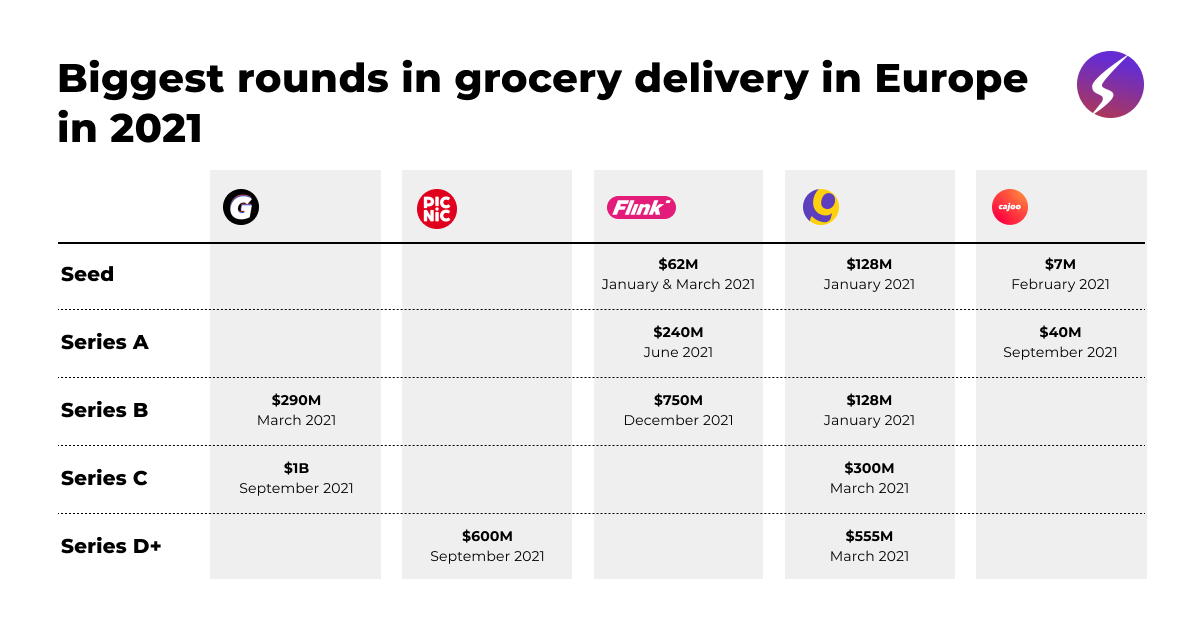

6. Grocery delivery funding madness will come to a halt

2021 has been a crazy year for grocery delivery funding. I mean… really crazy.

My bet is that this nonsense will stop. Funding of grocery delivery startups has been powered by the growing e-commerce demand due to Covid and the utter necessity for startups in the field to maintain high levels of cash to develop the business. But I believe the amounts of money that are being poured at the opportunity are grossly disproportionate to the size of the opportunity.

In the end, grocery delivery is a dog-eat-dog business where companies are left with little option but to compete on price, and where the strongest will win.

My assumption is that we will stop seeing crazy rounds in Europe, and that there will be a wave of consolidations from Big Tech acquirers (👋 Amazon) and failures from the least resilients.

7. European fintech will see at least two IPOs

My bet is that Klarna 🇸🇪 and Revolut 🇬🇧 will both go public this year. Nothing more than a bet. All I can tell you is that I agree with Crunchbase experts on this one.

8. DAOs will be the next big thing

DAO (Decentralized Autonomous organizations) are blockchain-based governance structure without hierarchical management. They have the potential to completely disrupt the way we think about organizational decision-making and distribution of capital.

I already told you about how a handful of crypto-enthusiasts managed to raise $40M from over 17K donors to buy a copy of the US constitution 2 months ago. There are many other applications where DAOs can be used including investment, charity, fundraising, borrowing, buying NFTs…

There are still unclear boundaries as to how to regulate them, but my guess is that we will see an increasing number of companies trying to build the infrastructure to prepare for the mass adoption of DAOs in the near future.

9. NFTs will stop being collectibles and focus on finding real applications

This one comes from the bottom of my heart. There has been a lot of FOMO behind the NFT movement, with investors throwing tremendous amounts of money at NFT and metaverse startups recently.

I truly believe that this bubble will eventually burst and that startups will eventually move away from focusing on collectibles to finding ways to use NFTs that are more valuable to the whole society.

🌍 All eyes on the EU... and elsewhere

European funding in January 🇪🇺

I experienced a little setback with Dealroom this week. We'll be back with this section next week. Apologies! 🙏

Payfit making it to unicorn status 🇫🇷

Payfit is French payroll and HR SaaS platform for small and medium companies. This week, the company announced it raised a €254M Series E round, reaching a post-money valuation of €1.82B, and becoming the 23rd French unicorn.

Delivery Hero and Glovo strenghtening their partnership 🤝

On New Year’s Eve, Glovo announced it had reached a new acquisition agreement with Berlin’s startup Delivery Hero that values the startup at €2.3 billion. Delivery Hero which was already a shareholder of Glovo with 44% shares, has now taken on an additional 39.4% – taking 83.4% control of the Spanish company.

That is some sort of delivery giants they are building.

Report on the French ecosystem

If you are interested in getting the full picture of what the French startup ecosystem looked like in 2021, I encourage you to read the below report by Alexandre Dewez.

Alexandre is a VC a Eurazeo, and he’s been doing a fantastic job picturing the ecosystem.

Thanks again for reading guys

See you next week 👋

Tim