Good evening Upscalers’ followers.

Apologies the 20th edition of this newsletter took a little more time to hit your mailbox. This week, we’ll try to figure out whether we’re living the greatest time in history to launch a startup 🚀

Feel free to like, comment, react and respond. Thanks for reading! And if you enjoy our content, why not join Upscalers as a member?

🚀 Are we living the greatest time in history to launch a startup?

Recently, I’ve been reading here and there that we might be living the greatest time in human history for startups.

Well… are we?

This question is highly contextual — I will as always, adopt a European approach first in trying to provide elements to answer it.

Here we go ⬇️

1. Regulation makes starting and operating a business easier than ever before

Regulation is key in enabling entrepreneurship. There is no so called “best time in history for startups” if economies don’t provide the context for entrepreneurs to start and run a business.

The World Bank’s Doing Business 2020 report offers a comprehensive view on how easy it is to start a business. It documents changes in regulation in 12 areas of business activity, and measures how efficient regulation is in supporting freedom to do business in 190 economies.

It is true that many countries worldwide have simplified their business start-up rules and adopted friendlier regulations for business operation over recent years (although not all countries and regions have progressed at the same rate). In Europe, the time and cost to start a business has decreased steadily (from an average 24 days and 9% of income per capita in 2009, to 12 days and 3% of income per capita in 2020), which promoted the creation of more companies than ever before.

Despite some evident progress, European founders still say that regulation is the second most important challenge that the European Tech ecosystem is facing right now, just behind Funding (Source - Atomico, State of European Tech 2021). Though the question’s scope is larger (covering all Tech related regulation), Atomico highlights the “ease of doing business” as an area where regulators could remove frictions to spin the European Tech ecosystem’s flywheel.

✅ So yes, regulation has never been so easy on founders willing to start up and operate a business in Europe… but there’s room to do better.

2. The startup founder’s stack makes it easier to launch the business

Beyond favorable regulatory context, founders have access to a larger-than ever stack of tools to launch the business, with low capital and technical knowledge requirements.

In 2011, Marc Andreessen famously observed that “software was eating the world”. Right. Today, any modern company runs on software while only a fraction of the world’s population is an active developer (≈ 30M developers worldwide, 0.4% of the world’s population). No wonder why we’re experiencing a developers shortage.

Today, 50% of European startup founders say developers are the hardest roles to fill. To add up on this, median salaries for developers have been climbing steadily for at least 20 years, topping $95,000 in annual pay for an Engineering Manager position in 2021.

Together with the developer shortage, the pandemic accelerated the urgency for every organization (from startups to large corporates) to create new digital applications and workflows in hours or days — not weeks or months. This powered the rise of no-code tools, and triggered a historic shift in how work gets done and startups are founded.

Today, anyone with a computer and access to the internet is able to build a product on the Internet without being a developer. No-code tools empower anyone to be an entrepreneur and start a business in a matter of days (if not hours). Below is just a snapshot of what you can do with this new founder’s stack of tools:

✅ It has never been easier to launch a business with no technical skills thanks to no-code tools.

3. Remote work paves a new way for team collaboration and hiring

On top of that, no-code tools and the pandemic paved a new way for remote teams collaboration, which makes it even easier to start and operate a business.

It is no longer necessary to find office space to start a company and buy office hardware (to some extent) to collaborate with your team. So why spend money on rent still?

Beyond simple capital gains, remote-first companies now have access to a worldwide talent pool and are no longer constrained to their local business operations area in their hiring process.

To illustrate this, Y combinator’s platform Work at a Startup (WaaS), which was launched in 2018, has seen a 6.4x increase in remote-friendly jobs in 2021 v. 2020, with 70% of jobs remote or “could be remote”. In 2019, 15% of small companies were building remote organizations. In 2021, that shifted to 86% of small companies (remote being defined as a company where at least 25% of roles have a remote option).

Whilst the future is uncertain, it seems very likely that remote work is here to stay and will benefit all future generations of tech entrepreneurs.

✅ Remote work removes the need for office space and widens the accessible pool of talents for startup founders.

4. Funding is widely accessible

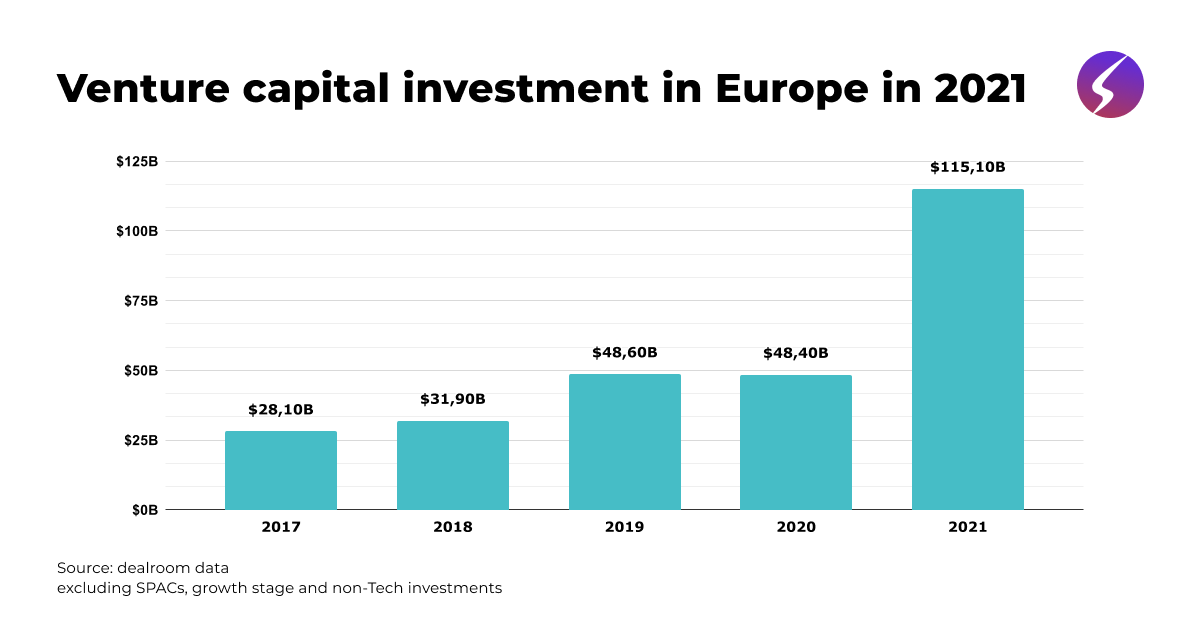

I’ve stated this many times already in past editions: funding has never been so accessible to European founders. Simple illustration: 2021 was a record year in terms of the amount of capital directed to startups through venture capital investments.

Not only is the amount of funding higher and growing (for how long? it seems that we are heading towards rather uncertain times), but it has never been so accessible through various fundraising sources. Yesterday, founders had to rely on VC funds to raise capital. Not anymore.

Here are some of the trends that widen opportunities for founders to raise funds:

Ex-entrepreneurs turning into investors 💫

Angel syndicates and communities popping everywhere (👋 Upscalers, Gen Z VCs…)

Blockchain-powered communities offering alternative sources of funding (through NFTs, DAOs…) 🔗

Revenue-based financing actually becoming a thing (remember when I told you about Capchase?) 💰

Public investment banks fueling ecosystems through grants 🤝

Accelerator programs increasing their ticket size to preempt the market (see “Why does Y combinator’s new deal mean for early-stage investors and founders?”) 📈

VC funds going down the ladder by launching their own Pre-seed and Seed funds to invest in early stage entrepreneurs 🔍

Startups building tools to ease the fundraising process — from platforms connecting founders to investors (Floww.io), to platforms bringing transparency to the fundraising process (Landscape) or apps to automate the fundraising process (e.g., Partyround) 📦

✅ So yes, funding from a variety of sources has never been so accessible

5. But funding is not everything

I know that funding is key. Failure to raise cash is one of the top reasons for startups to fail. But allow me to cast doubt upon the fact that startups raising bigger and bigger rounds is a good thing for the ecosystem as a whole (founders on top).

A few editions back, I commented on this Techcrunch article which argued that VC money was more efficient at killing startups than low customer adoption or team infighting. Today, with larger-than-ever amounts of money flowing down the ecosystem, young startups can find themselves with Millions despite limited traction (see median round size increase below).

I’m not saying that all rounds are disproportionate of course. I’m only wondering whether round sizes are adequate to capital requirements to ramp up a startup. When raising disproportionate amounts of money, startups are forced to hit the gas. The risk is to engage in a dead-end race, pouring unjustified amounts of money in inefficient investments to chase better metrics that would satisfy the demands of investors.

Techcrunch puts it this way: the core problem of VC is that "it incentivizes companies with good vanity metrics to start scaling bad experiments”. More funding flowing down the ecosystem does not mean higher startup success rates. The relationship between funding and success is not linear.

Similarly, it does not mean all founders benefit from better funding opportunities. Let’s remind for example that in 2021, European women founders raised the lowest proportion of total capital since at least 2017…

5. There is a myriad of new opportunities to build something new

There are indeed, a few exciting trends in their premises, creating opportunities to build profitable businesses. My head spins thinking about how many of them there is.

This newsletter has been for me the occasion to write about some of the industries / sectors where I find the most exciting opportunities. Some (rather broad) of them are ⬇️

Foodtech 🥗

… and more to come!

✅ So yes, the world is changing and there is space to build something new and exciting.

***

I did not seek to give an exhaustive list of criteria enabling startup founding and fueling the ecosystem, but only a snapshot of interesting trends that favor entrepreneurial behaviors, or slow them down.

While I don’t believe there will ever be “a best time for startups”, the current European context is particularly friendly to starting a business (despite some disparities from one country to another).

Anyhow, the key aspects of success are still the same: an opportunity, a vision to address this opportunity and a well-rounded team to execute with hard-work and dedication.

Thanks again for reading guys

See you next week 👋

Tim